Our Products

Life Insurance

Life insurance is the simplest and most affordable type of life insurance cover. This type of life insurance plan basically provides financial aid for a specified period only. It offers your beneficiaries an amount in lump sum or annually / monthly or a combination of both once you are gone. But, Life insurance doesn’t offer any paybacks, if you survive the term.

Education Policy

A child insurance plan pays a lump-sum amount equal to the sum assured on the death of the parent and the policy continues till the end of the policy term with all future premiums waived off. At the end of the policy term maturity, the benefit is paid to the child. Thus, parents can ensure that their child's needs are taken care of even if they are not around.

Endowment Plans

This type of life insurance plans offers both insurance as well as investment benefits. Endowment plans allocate certain value towards the life cover, while the balance value is invested by the insurance company. In this type of life insurance plan, bonuses are also declared periodically, which are paid either on maturity of the policy or on the death of the insured. A lump sum amount comprising of the life cover and accumulated bonuses is paid on maturity or after the specified duration, or to the beneficiary on the death of the insured whichever is earlier.

Money Back Life Insurance

In the Money Back Life Insurance policies, a periodic payment is made to the insured only if he is alive as a survival benefit. However, on death of the insured, the insurance company pays the entire sum assured along with the survival benefit.

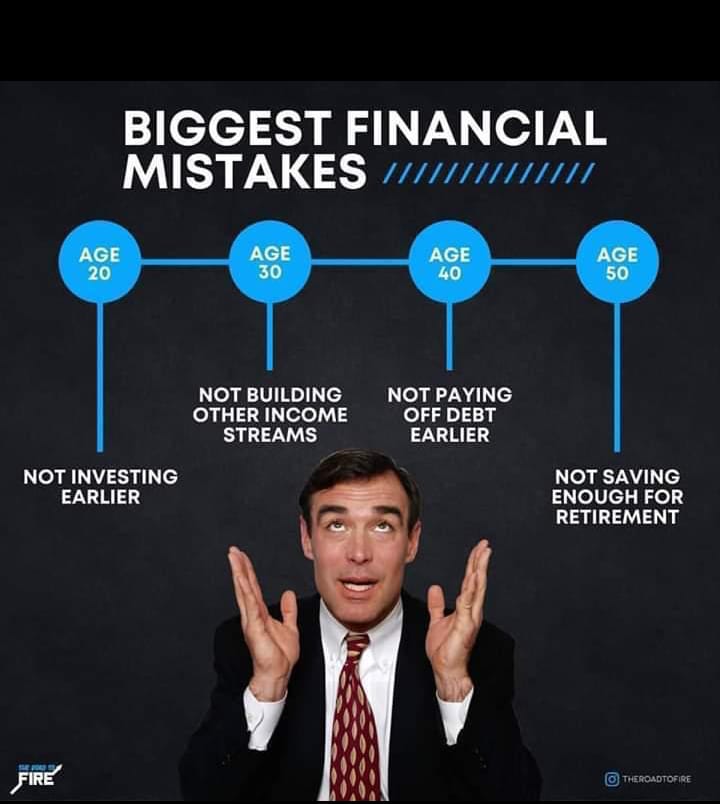

Pension Plan/Retirement Plan

A Pension plan helps in building a retirement corpus by inculcating saving habit within one. One pays regular premiums for a certain period of time after which he gets a regular income to have a happy retired life. This premium is invested by the insurance company into a safe fixed income product or in the markets as per one’s choice. On the determined retirement date, the accumulated amount is used for buying an annuity plan, which pays a certain income on a regular basis. These annuity payments can be either monthly, quarterly, half yearly, or yearly as per the options offered by the insurance company.

Term Life insurance

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified "term" of years. If the insured dies during the time period specified in the policy and the policy is active, or in force, a death benefit will be paid.

Medical insurance

To provide you with best health insurance coverage and to let you decide the right policy that suits your needs, we have various plans available.

Motor Insurance

Our motor insurance cover can be used to protect both private and commercial vehicles. Our car insurance cover helps you protect you and your vehicle. We have both comprensive and third party covers

Personal Accident

Personal accident insurance is an agreement between the insurance company and the person insured where the former will provide financial compensation to the latter or his/her family in case of permanent disability/death caused directly and only due to any accident.

Perfomance Bonds

Also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. For example, a contractor may cause a performance bond to be issued in favor of a client for whom the contractor is constructing a building.

Bid Bonds

The principal purchases the bid bond from the surety for a set price, much like a premium for an insurance policy.

Fire & Burglary

A fire policy will cover buildings, plant and machinery, rent payable and receivable and stock (e.g. for traders). Burglary provides financial compensation for loss or damage to property and valuable items due to burglary. ... Damage to premises as a result of burglary will be covered.

Marine Insurance

Marine insurance covers the loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. ... When goods are transported by mail or courier, shipping insurance is used instead.